Tuesday, June 28, 2016

Fiction, Investment Banking, And The Creation Of Reality

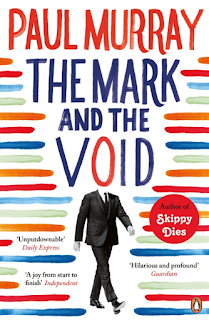

Last month I read this amazing novel called The Mark and the Void, nominally about a French guy who works in an investment bank in Dublin in the wake of the great financial crash of 2008, but really about global capitalism, the Greek economic crisis, the culture of banking, the fictional philosopher François Texier, simulacra, the creation of reality, climate change, art, literature, and love.

There are many varied plots, subplots, and metaplots, but the basic theme is how fucked up modern banking is and how that fucked-upedness affects and even creates our world. In the classic way that the fiction of literature can represent reality more effectively than the truth of something else, the book shows how the finance industry makes the world we are living in. The book is hilarious and you should read the whole thing -- but here are a few examples to whet your appetite.

Claude, the hero, is an analyst for the Bank of Torabundo -- "Torabundo" being a fictional island with longstanding indigenous culture that is now a tax haven. The Bank of Torabundo (BOT) survived the crash of 2008 because it had a cautious and careful CEO. So of course their next step is to fire that guy. How can you have a cautious and careful CEO in the context of modern banking?

To usher in their new era of growth, they install instead Porter Blankly, an aggressive lunatic who sends mass emails like "think counterintuitive" and has already destroyed several other huge banks. When someone naively asks, "Aren't they worried about history repeating itself?" Jurgen confidently replies: "History has already repeated itself with the last crisis. We do not think there will be any more repeating."

But just to make sure that "there is no more repeating," the bank finds they must avoid caution and care at all costs. Blankly's strategy is to acquire other banks, regardless of their status, thus pushing BOT further and further into debt -- so that eventually it can become too big to fall. As the banker Jurgen says: "A sufficiently large bank would create its own reality as opposed to simply reacting to consensus." Sound familiar?

There is one softy in the bank, a woman named Ish. Ish studied anthropology in school before becoming a banker, and she knows about Torabundo and the people who live there. She also knows that climate change is likely to destroy the island soon through rising water levels and that the people who live there are going to be wiped out.

She's such a softy that she decides to email Porter Blankly about it directly, hoping to persuade him to take steps or offer aid. This, of course, shows radical misunderstanding of the bank, of her place in it, and really of everything. Or, as her colleague puts it, "We're in the middle of not one but two giant takeovers, and she's writing the CEO letters, like my fucking eight-year-old asking Santa Claus to save the rainforest?"

Ish is clearly going to get fired for sending this absurd email -- until her friend Howie steps in. Howie, who is in charge of the creation of new economic instruments, immediately realizes that they can monetize the whole thing. In fact, they can hedge it so that the island's destruction gives then a direct profit. All they need to do is "monetize failure."

As Howie says, this is basically the concept behind credit-default swaps. At first, they were used to insure loans against defaultin. But then people started using them to bet on other people's loans defaulting. All BOT has to do is create, and then deliberatively target, losing propositions.

With Torabundo, it's easy. You set up a bunch of conventional investment to make people thing it is worth something -- hotels, a golf course (Ish: "A golf course?"). Then you put in your money in ways that create a bet on the failure of the investment. As Howie says, it's the ultimate hedge. If climate change wipes out the island completely -- you win big! And if it doesn't -- well, you still have the hotels and the golf course and all that crap.

As the plot moves along, our hero, who is sort of a cipher, becomes caught up in various things and in particular finds himself becoming more and more enamoured with an artist, Ariadne. Ariadne runs a restaurant, has family in Greece, and often brings leftovers to the diehard protestors who gather near the bank to try to convince the government to take action against the the forces of capitalism that are ruining their society.

Claude is slow to put it all together, but over time he comes to see the connections -- how the bank, through their chains of investment and the incentives those chains create, are causing the world to be a worse place. If you're too big to fail and you've monetize failure -- well, you see the problem. Eventually he comes to believe the bank is responsible for the suffering of Ariadne, and her family, her friends, and many other people, including the poor inhabitants of Torabundo.

At one point, Ariadne tells him with despair that her restaurant is going to have to close. The landlord has raised the rent, astronomically. She can't understand it: "I don' know who does the landlord expect to move in and pay his crazy rent. Or does he jus' want to force us out"?

Claude: "I start to explain the logic of upward-only rent review -- that the value of a building as an asset is based on the rent that could be charged for it, meaning it often makes more sense to keep that rent high and the building unoccupied than to lower the rent and have to mark down its overall ... " Ariadne just stares at him in bewilderment and horror.

When I read that I thought of all the empty storefronts in the poorer cities I've lived in, and how they'd often had thriving business in them, which had suddenly closed, and how often I had wondered to myself, "What the hell happened there"?

And now, maybe I know.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment